As is well known, Madrid receives productive investment flows mainly from OECD countries (Organization for Economic Cooperation and Development). These countries have accounted for 90% of investment since 1993, when data started to be compiled, and 86% in the last decade.

European countries, in particular large European economies and regional investment hubs have been the main source of investment in Madrid. Although these countries accounted for 88% of investment between 1993 and 2001, they have been giving way to increased investment from other locations. In the last decade, they accounted for 57% of the flows received by the region.

North American investments, thanks to the push of the United States and, to a lesser extent, Canada, already represented 20% of the flows received by Madrid in the last decade, compared to 7% in the previous one. Asia and Oceania have also shown a strong progression, with 15% of the total over the last decade (18% in the last five years).

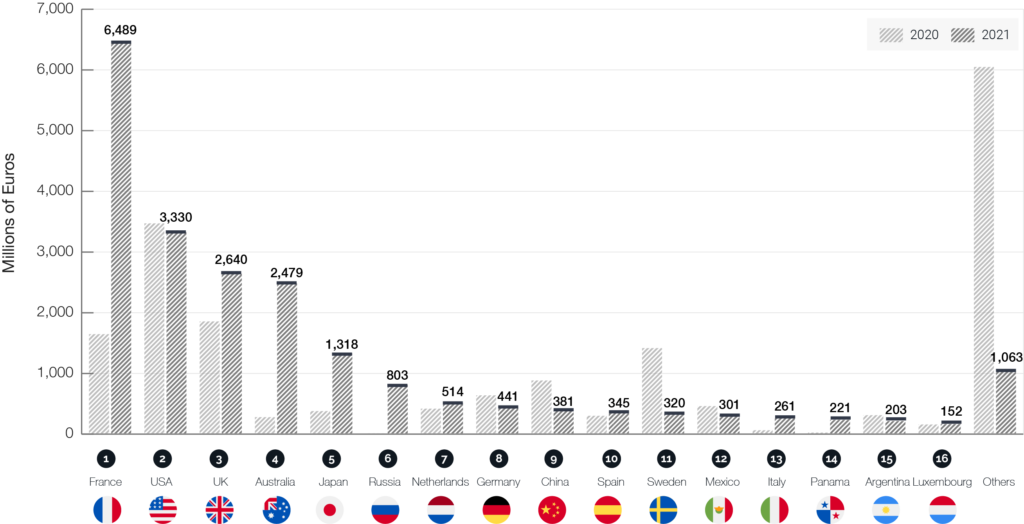

France, the United States, the United Kingdom, Australia and Japan concentrated 76% of investment in Madrid in 2021

Five countries exceeded 1 billion worth of investments in Madrid in 2021, accounting for 76% of investment in the region. France (6,489 million) was the main Investor country in 2021, thanks in large part to the purchase of Cobra (ACS) by Vinci, worth close to 5 billion. The United States (3,333 million) was the second largest investor, thanks to investments in the financial sector and in the manufacture of metal products, among other sectors. The United Kingdom (€2,640 million, with eight sectors receiving in excess of €100 million in the year), Australia (€2,479 million, its largest investment in Madrid to date, thanks to IFM’s operation in Naturgy) and Japan (€1,318 million, including the purchase of Elawan by Orix) complete the list of main investors in the year.

If we look at the data since the beginning of the series in 1993, we can see that the United Kingdom has been the main investor in Madrid, accumulating 20% of flows, thanks in part to investments in Telecommunications (€ 19,425M, mainly in 2000 and 2003), Tobacco (€ 12,624M, in 2008), Financial Services (€ 4,208M) and Air Transport (€ 4,200M, 2011).

The United States is the second largest investor in Madrid (13% of flows), having been the main investor in the last decade, though its investments are more spread out among different sectors (10 sectors above the 1,000 million invested in Madrid).

France (11% of the total), Italy (7.9%, of which investments in Energy in 2007, the largest foreign investment operation in Spain, played a major role) and the investments of subsidiaries of Spanish companies abroad (7.7%, thanks in large part to the operation of ACS on Abertis through its German subsidiary Hochtief, in 2018) complete the list of the top five investor countries in Madrid.

Figure 1. Foreign investment flows in Madrid by country of origin

Ultimate country, Millions of €, non-ETVE

Source: Investment Registry, June 2022

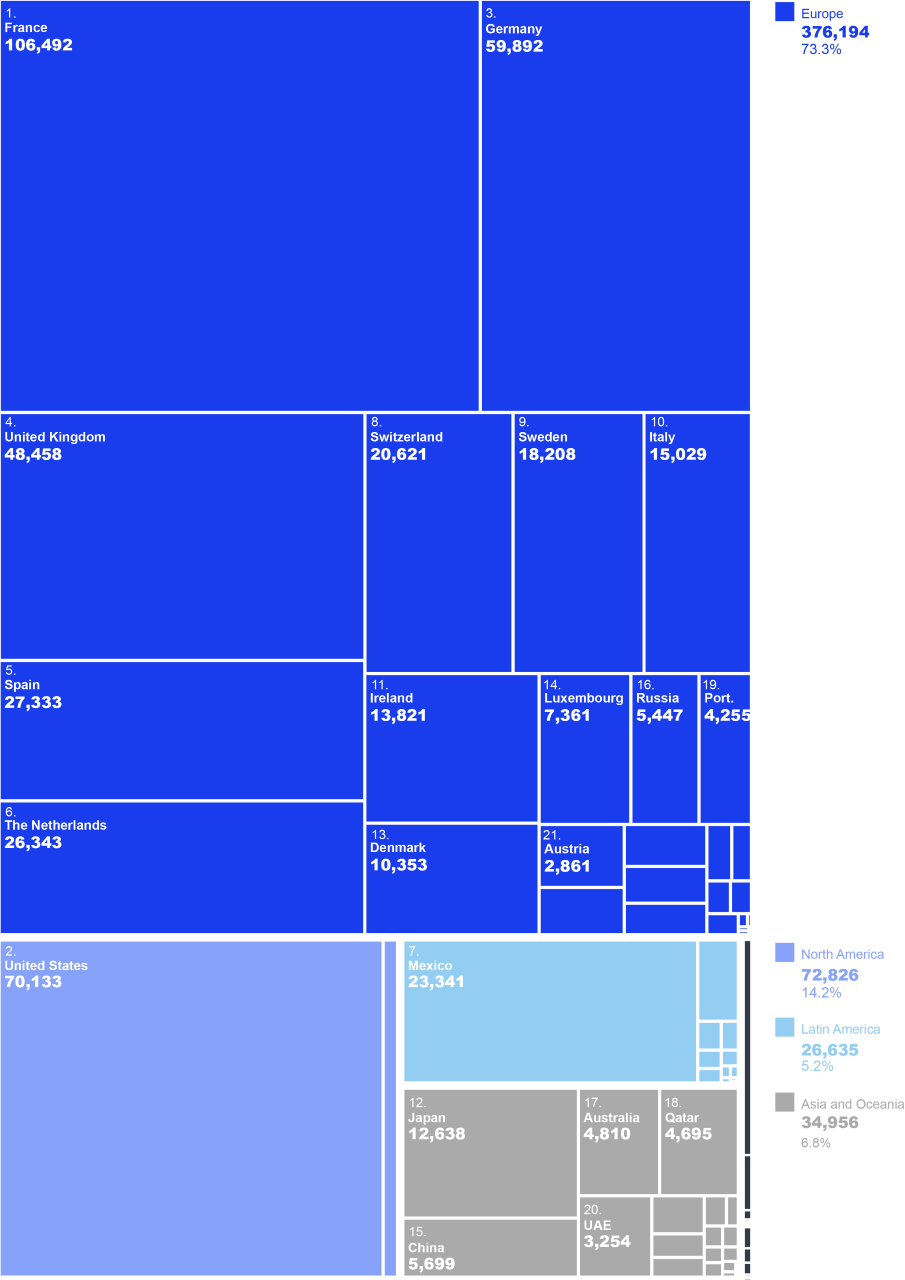

The top 10 investing countries concentrate 81% of employment linked to foreign investment in Madrid

The concentration of the origin of the investment is also evident if another variable such as the employment stock linked to foreign investment in Madrid is analyzed. The top ten investing countries accounted for 81% of employment in foreign companies in the region by the end of 2020, the last year for which data are available.

France was in first place, with 106,492 jobs (21% of the total), followed by the United States (70,133 jobs, 14%), Germany (59,892 jobs, 12%), the United Kingdom (48,458 jobs, 9.4%) and the subsidiaries of Spanish companies abroad (29,806 jobs, 5%). The list of the top ten investors in terms of employment generated is completed by the Netherlands, Mexico, Switzerland, Sweden, and Italy.

Europe thus concentrates 73% of employment, with eight countries among the top ten investors, ahead of North America (14%) and Asia and Oceania (6.8%).

Figure 2. Employment stock in Madrid by country of origin

Employment, non-ETVE, 2020

Source: Investment Registry, June 2022

Transit countries play an important role in channeling investment to Madrid

When analyzing the origin of the Foreign Direct Investment received in Madrid, there may be some confusion regarding the investments from the ultimate investing country, that is, the country in which the chain of ownership of the investment is exhausted, and the country through which the investment transits before arriving in Madrid (immediate country).

The Investment Registry offers data on both variables. The first approach is usually the right one in the vast majority of cases, since it helps to minimize the impact of transit countries or “fiscal convenience”. However, sometimes it is also of interest to analyze through which countries the investment is channeled before it finally arrives in Madrid. This second approach is also the criterion usually followed for the calculation of divestments and net flows, and the one followed by the Bank of Spain and the OECD.

In a context in which a significant part of FDI is linked to corporate restructurings, in which cross-border mergers and acquisitions play a major role, and in which the chains of ownership of international companies have become increasingly complex, the differences between the two criteria have been notable for some years.

Thus, according to the data of the Registry, Luxembourg would be the main country through which investment arrives in Madrid (21% of the total in the entire series), ahead of the United Kingdom (18%), the Netherlands (16%), Germany (9.4%) and France (8.3%).

Luxembourg plays a fundamental role of transit for large non-EU investors such as the United States (it channels 47% of its investment in Madrid) or Australia (concentrating 64% of its investment), while also serving as a conduit for part of British investment (17%) and, to a lesser extent (9.4%), of France. The Netherlands, for its part, concentrates 16% of US investment, 34% of Australian investment, 14% of French investment, and only 3% of that of the United Kingdom.

Large European countries tend to make marginal use of these transit hubs to invest in Spain. Italy invests 94% of flows directly, Germany and the United Kingdom 79%, and France 73%.