The increase in acquisitions of Spanish assets located in Madrid consolidates the capital’s importance as an investment hub.

Last year, Madrid received 17,9 billion euros of gross productive investment, 23.6% more than the previous year, according to the information provided by the Foreign Investment Registry (RIE), which was published a few days ago. This data shows that the Madrid region has absorbed 75.2% of total gross foreign investment (FDI) received by Spain. Thus, foreign investment in Madrid accounted for 7.5% of regional GDP in 2020 or 2,642 euros per inhabitant.

The global pandemic has brought on a significant reduction in foreign investment flows (FDI), calculated at 42% in the first UNCTAD estimates, which would place these global flows at $ 859 billion. This decline would reach 71% in EU-27 countries.

Spain has gone against the grain, with last year’s flows (23,8 billion euros) similar to average investment flows in the past decade. Spain’s improved performance is due to several acquisitions, among which it is worth mentioning that of MásMóvil by a group of Private Equity funds (KKR, Cinven and Providence) from the United States and the United Kingdom, and the purchase of BME by the Swiss stock exchange SIX Group, which has placed Switzerland, the United States and the United Kingdom as the main investors, both in Spain and Madrid.

In 2020, Madrid received productive flows mainly from other OECD members (85%), especially European countries (60.2%, in line with its average in the last decade). In addition to the three countries mentioned above, France, Sweden and Qatar exceed the 1 billion mark for the year. The ten main investing countries concentrated 85% of the investment in the year.

The greater presence of takeover operations (43.1%, almost 10 points above the average for the decade) in the flows received in 2020, together with the shareholdings in Spanish companies, most of which are located in Madrid, have increased the concentration effect in the capital region, which varies each year according to the size of the operations. In a particularly anomalous year, only Extremadura, Murcia, the Basque Country and Madrid, improved their performance compared to 2019, thanks to significant one-off operations.

In line with previous years, the Services sector absorbed the largest volume of flows in Madrid (77.8% of the total), followed at a distance by Industry (24.5%) and Construction (9.6%). The primary sector continues to have a marginal presence in the flows (0.6%). Investments in Auxiliary activities to financial services (2,7 billion), Telecommunications (2,1 billion) and Financial services (1,7 billion) stand out. Three other sectors (Construction, Information Services and Air Transport) also exceed 1 billion invested in Madrid in the year.

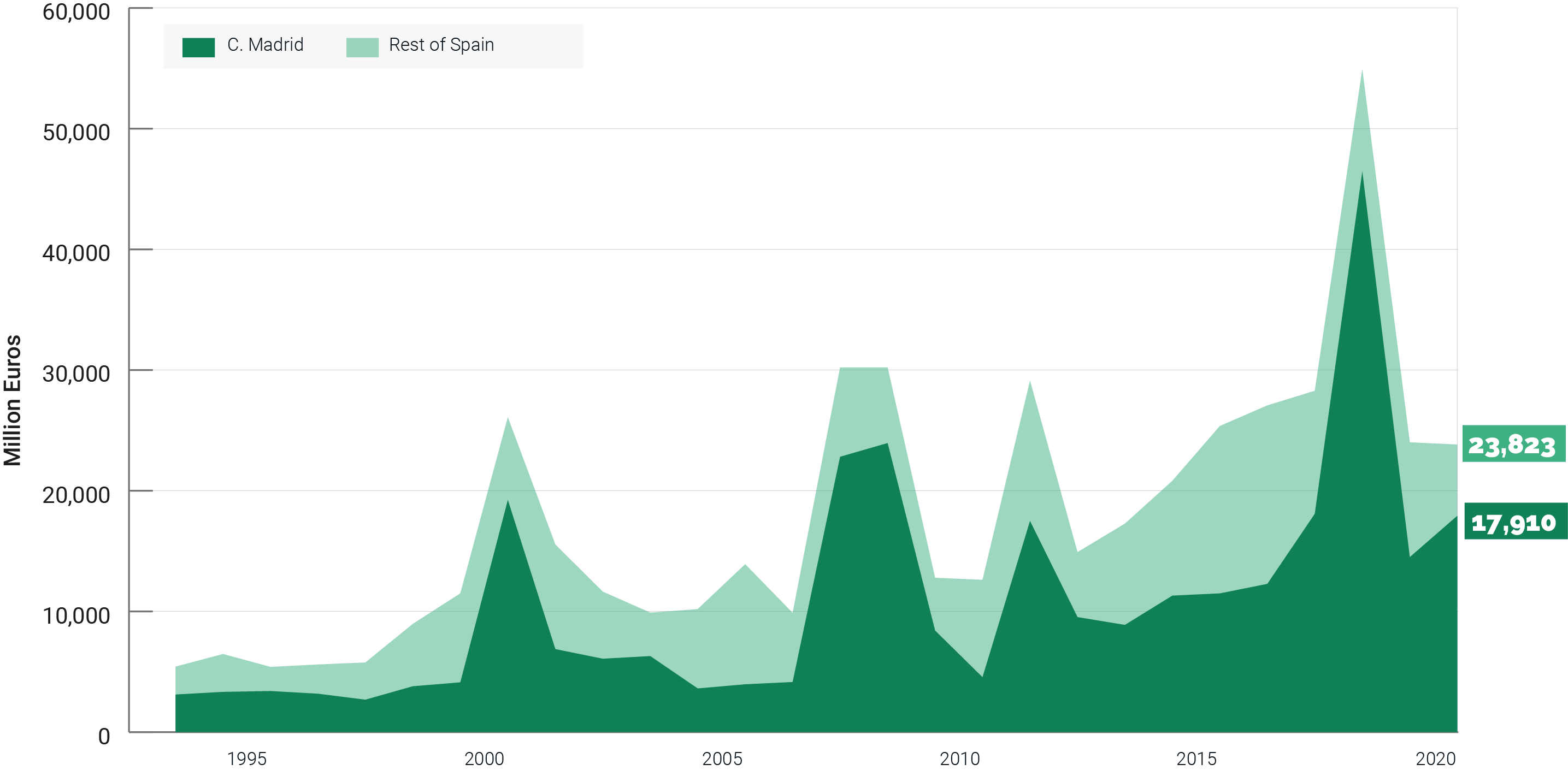

Figure 1. Evolution of gross productive FDI flows received in Madrid, Millions of euros, Non-ETVE

Source: Investment Registry, March 2021

Being the capital region favors concentration of investment flows in Madrid, as a result of the strong headquarters effect (3.87) on the nation as a whole, an effect which is very typical of European countries’ capital regions. It should be noted that, with little more than 14% of the Spanish population and 19% of GDP, the accumulated stock of FDI in Madrid amounts to more than 71% of the national total, a percentage that has not stopped growing since 2013. According to the INE’s latest data, Madrid concentrates over 330 billion euros of FDI, approximately 143% of regional GDP.

Greenfield investments received by Madrid in 2020 were also notable, although the concentration in relation to the whole of Spain is significantly lower. Thus, and according to the information provided by Fdi Markets, last year Madrid received 131 investment projects (24.3% of the national total) amounting to 2,8 billion euros (21.4% of total investment received by Spain). These new projects generated a total of 15,256 jobs. Since 2003 Madrid has received 1,987 investment projects that have created 165,018 new jobs.

To get a clearer picture of foreign investment in Madrid we must analyze the business factor. Indeed, according to the INE’s Affiliate Statistics, Madrid has 5,462 foreign capital affiliated companies (in the industrial, commercial and non-financial services sectors), which, although they represent only 1.52% of the total number of companies present in these sectors, they employ 876,488 people, have a turnover of more than 322 billion euros and are responsible for more than 70 billions of Madrid’s exports.

The Madrid City Council is aware that Madrid’s good performance in terms of FDI attraction reflects the attractiveness of the city as an investment destination, its inherent advantages and the favorable business climate for investment. Indeed, at Madrid Investment Attraction (MIA) (https://madridinvestmentattraction.com/), we believe that facilitating the attraction and maintenance of foreign investment are crucial, even more so in the current international scenario marked by changes in the dynamics of international production, uncertainty regarding the new criteria that will direct investment and the growing competition from cities and territories to extract greater value from sustainable international flows.

For this reason, we will continue adapting our services to this new reality, with the aim of offering the best possible solutions to investors. The city of Madrid has indeed the potential to attract a large volume of investment, increasing the wealth, employment levels and well-being of its citizens.