2019 is coming to an end and it is time to look back and cast an eye on the foreign investment figures in Madrid. The data that have been appearing throughout the year, which mainly concern the investment activity of the previous year, have been exceptional. Madrid absorbed a total of 41.6 billion euros of gross foreign investment in 2018, more than 85% of the national total and 146% more than the previous year. All this in a context in which global FDI flows decreased by 13% for the third consecutive year in 2018, with developed countries bearing the brunt of the fall, in contrast to their increased prominence in previous years.

While it is true that these data are affected by the impact of a single operation (Abertis, 14 billion euros) on total flows and that Madrid benefits from a “headquarters effect” because of the way investment is allocated to companies headquarters and the fact that Madrid is the Capital city, 2018 was an exceptionally good year for the Community of Madrid, with ten sectors exceeding 1 billion investment in the year, even if we exclude the aforementioned investment.

Madrid has traditionally been the main receiving region for productive investments in Spain, and it is noteworthy that the economic attraction of Madrid for international capital is not detrimental to other Spanish regions. Thus, all of them have seen an increase in foreign subsidiaries in their territories during the last decade, as well as in the jobs and turnover generated by them.

According to the statistics of Foreign Subsidiaries in Spain of the National Statistics Institute INE (FILINT), which were published in September this year, the number of employees, the value of production and turnover, as well as the added value of the foreign subsidiaries in Spain have increased in the last decade (2008-2017) in all Spanish regions.

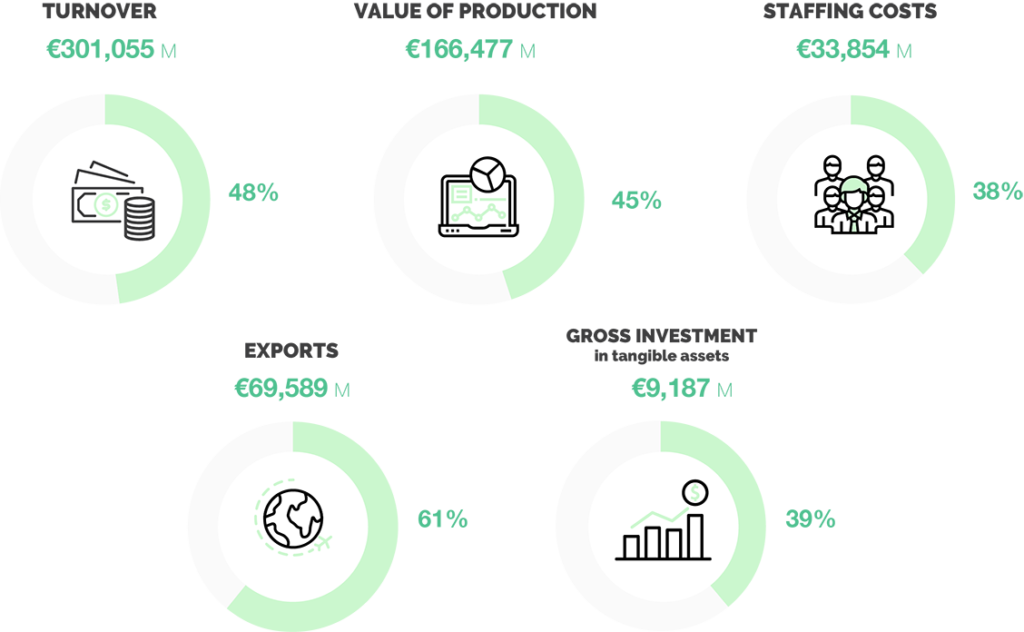

This same source indicates that Madrid has 4,831 subsidiaries of foreign companies, 37% of the total in Spain, which occupy a total of 812,993 people and generate a turnover of 301 Billion euros, more than 50% of the business that these subsidiaries generate in Spain, and about 30% of the business that all the companies present in Madrid obtain in the sectors analyzed by the INE. The number of foreign companies has not stopped growing in Madrid and these are mostly concentrated in the services, commercial and industrial sectors and come from the countries that lead foreign investment in the country: France, Germany, the United States and the United Kingdom.

Impact of foreign subsidiaries in Madrid

Value and percentage of total

The investment stock, the indicator that shows lasting investor confidences in the local economy and its companies, has also set a maximum in the historical series for Madrid: 269 Billion euros according to the latest data (2017), 68% of the national total. This stock also exceeds the GDP of the Madrid region, close to 220 billion in the same year, which gives us an idea of the strong headquarters effect when interpreting data related to foreign investment.

The general feeling for this year that is now ending is ambiguous, according to the different data that have been advanced by world institutions such as UNCTAD, the OECD or the Investment Registry in Spain.

In the international arena, the advanced data for the first half of 2019 is 24% higher than the anomalously low first half of 2018, but 23% lower than the previous semester, which is still below the average of the last decade. Much of the decline is due to the repatriations of profits carried out by multinational companies in the United States after the tax reform carried out in that country at the end of 2017, repatriations that, in general, have been more moderate in Europe in 2019.

The figures for 2019 are thus expected to be moderately positive (anticipated growth of 5-10%), although the underlying FDI trend remains weak due to factors like the decline in rates of return on FDI, the use of forms of investment that are lighter in tangible assets and less favorable investment policies, together with the downward trend in trade linked to global value chains.

At the national level, the first half of 2019 reveals moderate foreign investment flows according to the RIE (Foreign Investment Registry): 10.3 Billion euros, of which 63.7% (6,5 Billion) went to Madrid. It is still early to predict how the year will end, which will depend on the specific operations that are closed, which will not show up in the data until well into next year. However, everything points to both the Spanish and the Madrid economy, which absorbs more than half of the flows, attracting less flows than in 2018, in line with the foreign investment trends in European and world countries.

Additional information

If you want to know more about foreign investment in Madrid, we recommend the following articles and case studies:

Madrid FDI data stands out in an unfavourable context

Madrid, undisputed leader in FDI in 2018. Nine sectors with investments exceeding one billion euros

Foreign Direct Investment in Madrid, Economic Barometer of the city of Madrid 52