International investors have had precious little to cheer about of late. Trade barriers are piling up, security clearances stretch ever longer and geopolitics is as volatile as at any point since the Cold War. Yet amid the turbulence Spain has proved sturdier than many of its peers, and Madrid has repeatedly demonstrated that it can keep global capital engaged even when the wider tide is running out.

The opening quarter of 2025 is a case in point. At first sight the €4.07 billion in foreign direct investment (FDI) booked nationwide looks subdued beside the first-quarter averages of the past decade. But that headline masks an important truth: Spain continues to attract sizeable, productive commitments when much of the world is experiencing double-digit declines. Equity and reinvested earnings still account for the lion’s share of inflows (€3.46 billion), while the inclusion—since 2024—of intragroup financing gives a clearer picture of the multinational ecosystems already rooted in the country.

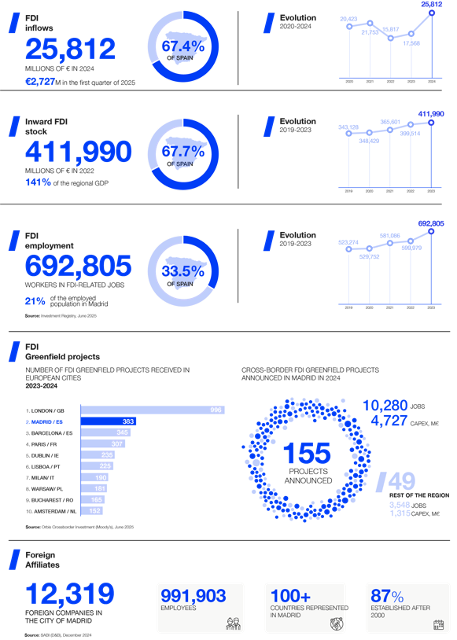

Madrid’s performance is even more striking. The region drew €2.73 billion in gross inflows between January and March, two-thirds of all foreign capital entering Spain. Catalonia captured €451 million (11.1%), Cantabria €177 million (4.3%), the Balearics €140 million (3.4%) and Valencia €125 million (3.1%), with the rest scattered thinly across the map.

Net of disinvestments, the capital still banked €1.51 billion—ample evidence that foreign groups are rolling forward rather than rolling back.

Quarterly data can exaggerate swings caused by one-off megadeals and by the seasonal rush of filings at the end of the year. Even so, Madrid’s resilience rests on solid structural ground. Holdings vehicles (ETVEs) now play only a minor role, signalling that the money coming in is linked to real projects rather than treasury engineering.

Almost half of the funds received in early 2025 financed brand-new facilities or expansions, underlining investors’ long-term faith in the region’s talent pool, infrastructure and pro-business stance, while cross-border acquisitions took 33.3% and follow-on expansions 24.9%.

In a mirror image of 2024, corporate investors supplied nearly half the investment in Madrid (44.9%), ahead of private collective vehicles such as PE and VC funds (37%), individual investors (7.1%) and sovereign wealth funds (6.1%).

The United Kingdom, France and Singapore lead the way in 2025

Drill down into the origins of Madrid’s first-quarter investment and an eclectic line-up emerges. The United Kingdom leads the field with €544 million (19.9%), channelled mainly into information services and back-office administration. France follows on €421 million (15.4%), driven by headline deals in energy supply and financial services. Singapore – whose tech investors have grown increasingly comfortable in Madrid’s cloud and data-centre scene – posted €388 million (14.2%), again heavy on information services. The United States chipped in €331 million (12.1 %), skewed towards real-estate activities, while Mexico completed the top five with €250 million (9.2 %), splitting its bets between food-and-beverage trade and real estate.

Sectorally the picture is equally concentrated. Information services banked €799 million (29.3%) in Madrid, continuing the surge seen in 2024. Real-estate activities claimed €395 million (14.5%), financial services drew €254 million (9.3%), while energy supply secured €241 million (8.8%) – notable in an era when renewable deals are slowing worldwide. Rounding out the leaders were accommodation services with €176 million (6.5%), reflecting the capital’s resilient tourism bounce-back.

Taken together, the country and sector breakdown underscores a familiar story: Madrid’s ecosystem of multilingual talent, digital infrastructure and high-density corporate services continues to attract Anglo-Saxon capital, the French energy majors and a rising cohort of Asian and Latin American investors.

The long view: stock counts still paint a resilient picture

Quarterly gyrations aside, what matters for wages, tax receipts and technology spillovers is the stock of foreign capital embedded in the region. On that score Madrid’s trajectory remains unambiguously positive. The Registry’s stock series – derived from corporate annual reports and therefore subject to an 18-month publication lag – shows €411.99 billion of productive FDI on the books in 2023. That is 3.1% higher than in 2022 and fully 161% above the pre-crisis baseline of 2007.

Put differently, the stock now equals 141% of regional GDP, or €61,375 per citizen. Madrid’s share of Spain’s overall inward FDI stock has crept up to 68%, five percentage points more than in 2007 and far ahead of Catalonia (13%), the Basque Country (4.8%), Asturias (3.0%) and Valencia (2.7%).

Behind the headline growth lie two forces. First, Madrid’s services-heavy economy – hosting the headquarters of most blue-chip Spanish multinationals – naturally intermediates inward flows destined for projects across the Iberian Peninsula and, increasingly, Latin America. Second, the region has succeeded in anchoring life-cycle investments: once a foreign manufacturer or data-centre operator establishes a Spanish hub in the capital, the tendency is to reinvest earnings locally rather than repatriate them.

Global investors are plainly more cautious in 2025, and Spain is not immune. Yet even in a quarter when flows receded sharply, Madrid continued to dominate the national scoreboard and to diversify its base of source countries and sectors. The task for MIA now is twofold: keep the door open to productive newcomers in an era of tighter screening, and convert today’s smaller trickle into tomorrow’s larger stock. On recent evidence, foreign capital still judges that Madrid is worth the wait.