Madrid has a competitive and modern tax system. In fact, it is the region with the best tax competitiveness index in Spain – a country where the fiscal burden is 4 points lower than the average for EU-27 countries.

Spain has signed as many as 94 double taxation avoidance agreements. Moreover, it is one of the countries with the widest coverage by this type of agreements in Latin America.

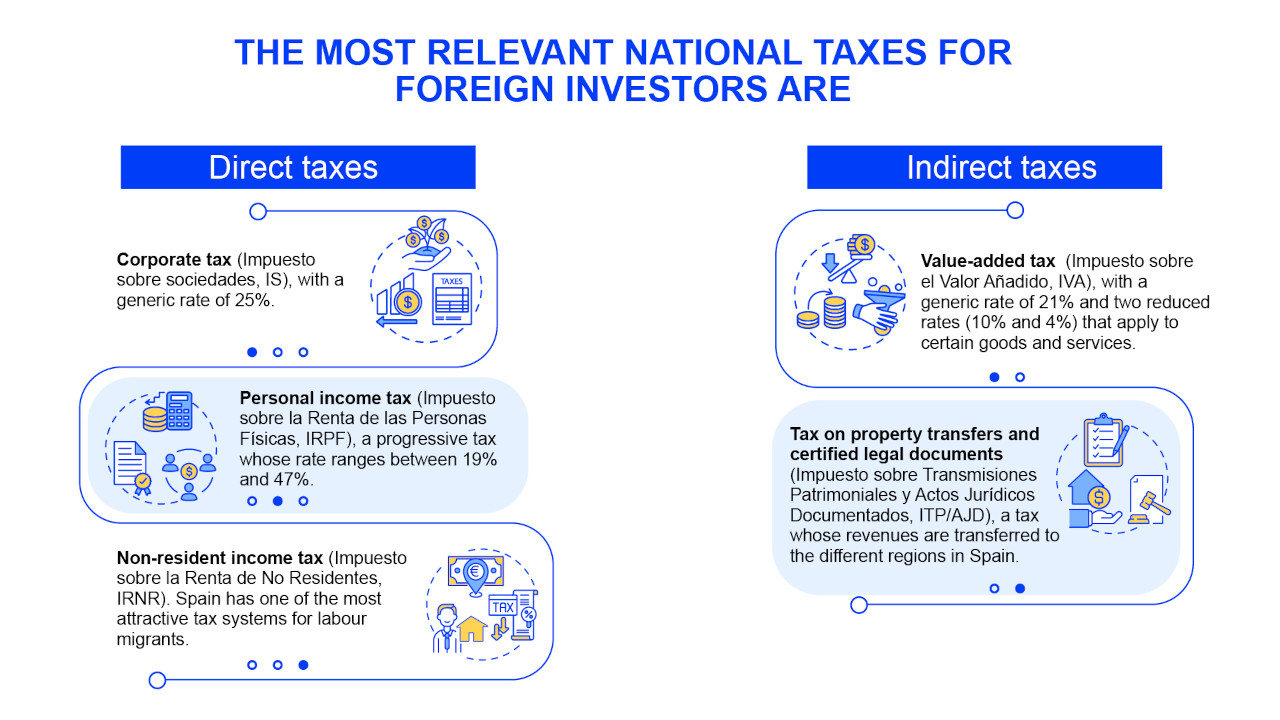

The Spanish tax system includes both national and local taxes.

The most relevant national taxes for foreign investors are:

The main local taxes are those imposed on a periodic basis, such as the property tax (Impuesto sobre Bienes Inmuebles, IBI) and the trading income tax (Impuesto sobre Actividades Económicas, IAE), and others like the construction tax (Impuesto sobre Construcciones, Instalaciones y Obras, ICIO).

The chapter dedicated to the Tax System in the Guide to Business in Spain published by ICEX-Invest in Spain and Garrigues offers information about the different types of taxes and tax incentives, including scenarios and practical examples.

|

The team at Madrid Investment Attraction (MIA) will be glad to answer all your questions about the taxes and tax regulations applicable in Madrid.